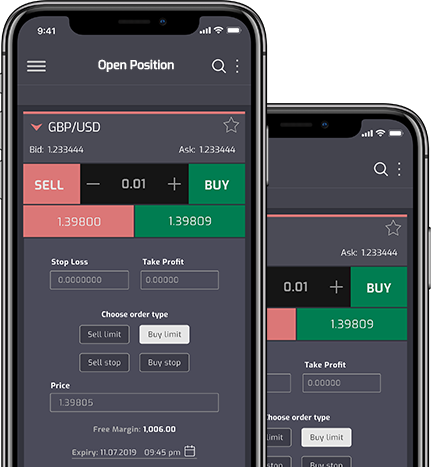

Open your account

Applying for an account is quick and easy with our secure online form, and you could be trading within minutes.

The international currency market of "FOREX" (Forex, Foreign Exchange Market) — is a set of operations on foreign currencies purchase and sale.

"FOREX" has no concrete location for tendering. Transactions between bidders are carried out by means of the Internet, thus one party can be in Europe, and another in Asia.

Key participants of the currency market are the central and commercial banks, investment funds, broker companies, dealing centers, and also individual traders.

Market makers (from English market maker, the founder of the market) on the currency market — it is the companies which accept risks. They own a certain quantity of currency for trade maintenance on it, even when the market is illiquid.

The broker (from English broker, the intermediary at the conclusion contract) — is the company or the legal entity, the professional participant of the market, who has the right to make trade operations at the request of the client and at his expense or on his own behalf and at client expense on the basis of onerous contracts with the client.

The trader (from English trade, trade) — is a person committing operations on the currency market. He earns on the rate fluctuations of world currencies. The essence of the market participant activity consists of the information analysis, forecasts creation and transaction at the necessary moment. The key to success of the trader — the knowledge of bases of the fundamental and technical analysis, rules of capital management, the main aspects of exchange trade psychology.

The main currencies on the currency market are US dollar (USD), euro (EUR), Japanese yen (JPY), British pound (GBP), Canadian dollar (CAD), Australian dollar (AUD) and Swiss franc (CHF).

Everything depends on desire of a trader and that, how much time and effort he is ready to devote to work on the currency market. As many professionals experience shows, it is real to earn 100% a year and even more on the “FOREX” market.

The international currency market is not a lottery where it is worth relying only on an occasion. For success achievement it is necessary the knowledge which can be gathered from books, subject magazines, Internet resources, and also at webinars, seminars and courses which are held by experts. For successful trade on "FOREX" it is necessary to study the principles of work and bases of the currency market analysis. The insufficient level of knowledge and qualification of the trader can lead to losses.

Begin with the examination of schedules, analyze, and carefully follow trend changes. Constantly be engaged in self-improvement — study subject literature. You will surely find all on the «ActivMarket» Company site: (www.activmarket.com). Adhering to the similar scheme, soon you will achieve success. To trade it is better to begin with a demo account. However many professionals hold to the opinion that work on a demo account doesn't give a complete image of real trade on the FOREX market and therefore it is better to begin with small, but the real sum on the real trading account. So it is up for.

On the FOREX market your diploma isn't important. As practice shows, the one who really aspires to it achieves success only. The main thing is your desire to master currency trade, and you will be able quickly to learn all necessary things, because today a trader has an opportunity to use the mass of free educational resources to gain necessary knowledge and skills for trade on "FOREX".

Not necessarily. The trade platform "activmarket.com" and any others which exist in the different companies, is provided in English. You can find all other necessary materials in Russian on our site and on other subject resources.

Hedging (from English hedge, an insurance, a guarantee) — this insurance of risks of the price changes. It is carried out by the conclusion contracts on the forward markets. The first operations with futures were put into Chicago with the purpose to protect goods from sharp situation changes on the currency market. The mechanism of hedging consists of obligations balancing, i.e. opening of counter positions on currencies purchase and sale.

The spread (from English spread, a difference) — is a difference between the offer on currencies purchase and sale. The spread — it is that broker "earns» on the transactions of clients.

Applying for an account is quick and easy with our secure online form, and you could be trading within minutes.